Refinance or Renovate? Making the Most of Your Equity

Your home is more than just a place to live—it’s one of your most valuable assets. If you’ve owned your home for a while, there’s a good chance you’ve built up significant equity. That equity presents an opportunity: you can tap into it to make your financial life easier or invest in your property to make it more comfortable and functional. But what’s the smartest move? Should you refinance to lower your monthly payments or cash out some equity to fund home improvements? The right decision depends on your personal goals, finances, and how you envision your future in the home.

Your home is more than just a place to live—it’s one of your most valuable assets. If you’ve owned your home for a while, there’s a good chance you’ve built up significant equity. That equity presents an opportunity: you can tap into it to make your financial life easier or invest in your property to make it more comfortable and functional. But what’s the smartest move? Should you refinance to lower your monthly payments or cash out some equity to fund home improvements? The right decision depends on your personal goals, finances, and how you envision your future in the home.

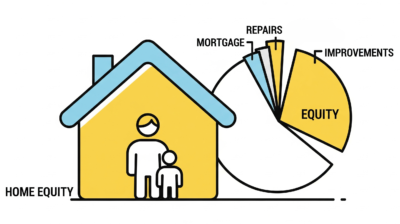

What Is Home Equity?

Home equity is the difference between your home’s market value and what you still owe on your mortgage. As you pay down your loan balance and your home appreciates in value, your equity increases. This growing equity acts like a savings account you can access through a variety of financial tools, particularly refinancing options. Understanding how to use this equity wisely is key to making informed decisions that align with your long-term financial goals.

Whether you’re looking to reduce your interest rate, shorten your loan term, or invest in your home’s infrastructure, equity provides the financial flexibility to make it happen. However, different strategies offer different advantages, so it’s important to weigh your options carefully.

Refinance: Lower Your Rate or Restructure Your Loan

Best for: Reducing monthly payments, shortening your loan term, consolidating debt, or switching from an adjustable-rate to a fixed-rate mortgage.

If current interest rates are lower than when you first purchased your home, refinancing might be a smart move. Even a seemingly minor drop in interest rate—say, from 6% to 5.25%—can add up to substantial savings over the life of your loan. A refinance can help lower your monthly payment, improve your cash flow, and potentially save you tens of thousands of dollars over time.

Another benefit is the opportunity to restructure your mortgage. You might choose to move from a 30-year loan to a 15- or 20-year term, allowing you to pay off your mortgage sooner and save on interest. Refinancing is also useful if you originally had an adjustable-rate mortgage and want to switch to the predictability of a fixed rate.

This type of refinance doesn’t necessarily increase your debt. You’re not borrowing additional funds, just reworking the terms of your existing loan. That makes it ideal for homeowners focused on improving their financial position without taking on new projects or expenses.

Renovate: Upgrade Your Home with a Cash-Out Refinance

Best for: Increasing your home’s value, enhancing your living space, or making upgrades that better suit your lifestyle.

If you’re dreaming of a modern kitchen, a new bathroom, or more square footage, a cash-out refinance can make those upgrades possible. This approach replaces your current mortgage with a new, larger one, and the difference between the two loans is given to you in cash. You can then use that money for renovations, repairs, or upgrades that make your home more functional, efficient, or enjoyable.

Home improvement projects can also add real value to your property. A remodeled kitchen, new siding, or energy-efficient windows may increase your resale value and attract more potential buyers if you ever decide to sell. In some cases, these improvements can even pay for themselves over time by lowering utility bills or reducing maintenance costs.

Keep in mind that a cash-out refinance results in a higher loan balance, so your monthly payments may increase. However, if you’re using the funds to enhance your home or lifestyle and you’re financially prepared, it can be a worthwhile investment.

How to Decide Which is Right For You

Choosing between a traditional refinance and a cash-out refinance involves more than just comparing interest rates. Think about your broader financial picture and long-term plans:

What are today’s interest rates compared to your current rate? If rates have fallen, refinancing could make a lot of sense.

What are today’s interest rates compared to your current rate? If rates have fallen, refinancing could make a lot of sense.- How long do you plan to stay in the home? If you’re moving in a few years, investing heavily in renovations may not provide the return you expect.

- What’s your monthly budget? Consider whether a higher mortgage payment fits comfortably into your budget if you opt for a cash-out refinance.

- What are your renovation goals? Are they cosmetic or structural? Lifestyle-driven or resale-oriented? Knowing this will help guide your decision.

- Do you have other debts to consider? Some homeowners use a cash-out refinance to consolidate high-interest debt, using their home equity to pay off credit cards or personal loans at a lower rate.

A qualified mortgage professional can help you navigate the pros and cons of each option and determine which is best aligned with your current and future needs.

Let Your Equity Work for You

Your home equity is a powerful resource that can help you create financial freedom, build value, or simply make your home a more enjoyable place to live. At First Ohio Home Finance, we’re here to help you make informed choices that make the most of your investment. Whether you’re looking to refinance for a better rate or fund a renovation project that brings your vision to life, our team is ready to guide you every step of the way.

Contact First Ohio Home Finance today to see how your equity can work harder for you. Let’s talk about your goals and find the right path forward.