5 Things You Can Do to Secure Your Financial Future

While money may be able to buy you tangible things like cars, clothing, and food, it can also buy you intangible things like freedom and choice. The reason being is the more money you acquire and allocate to the proper places, the more financial security you will gain, therefore setting yourself up for financial freedom in the future. Practicing good financial habits will not only set you up for financial freedom but it will give you more leverage when it comes to obtaining a mortgage loan too! Here are five things you can do now that will help to secure financial freedom for you down the road.

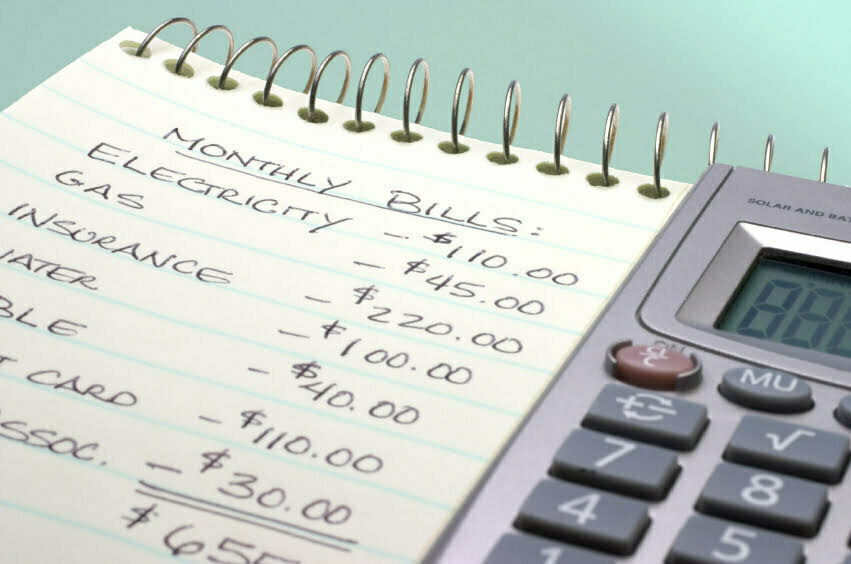

- Track your spending – In the day and age that we live in, cash is not the primary way to spend money anymore. With debit cards and even credit cards, we don’t realize the amount we are spending as easily because we do not see it diminish like we would with cash. This makes it hard to understand how much is leaving our account each day. In order to feel secure with your money each month, it is imperative to track your spending habits and set a budget. There are a lot of great online resources to help you do that such as Mint.com and LevelMoney.

- Set financial goals – Have you ever traveled without a map (or should we say the map on your iPhone) ? It would be difficult, if not impossible, to get to your destination, right? Just like traveling, we need to follow a map for our finances too! By setting financial goals and dates in which you want to achieve these goals, it will help you to stay accountable and on track, helping to eliminate useless spending and reach goals (ie, saving for down payment).

- Save for retirement – When you reach your Golden Age, as many call it, you want to be able to have your days filled with choices, not obligations (i.e, work). The earlier you create a savings account or investment account (Recommended) the sooner you can make this jump into the retirement world where your days can be filled with traveling, spending time with grandkids, or just simply relaxing. If your company offers a 401K program, it is advised to take advantage of this. Remember this will allow you more freedom later in life!

- Treat your savings account like a bill – Have you ever heard the saying, “Pay yourself first” ? If not, it means,right when you get your paycheck, take a portion and immediately put into your savings account. By using up whatever you have leftover each month to apply to your savings, you are cheating yourself in that you are not setting yourself up for more financial freedom in the future. Let’s paint a picture for you, imagine you have an unexpected car expense and your option is to put it on a credit card with an APR of 20% (or higher) or use money in from your emergency fund (no interest) which do you think will give you more financial freedom in the future? Obviously, using the money you have saved. Yes, you will have to build your savings back up since it was depleted but you won’t have to pay 20% extra on top of that amount. For a $1000 balance on a revolving credit card with a 20% APR you are looking at an extra $200 in fees!

- Seek financial knowledge – Unfortunately, personal finance is not something that is commonly taught in high schools, if even at all! Finances can be a tough subject matter, sometimes a sensitive one for most people. Learning how to take control of your personal finances is more of a trial and error experience (an expensive one at that!). Thankfully we are equipped with information, tools and resources (thanks to the internet and technology) that can point us in the right direction when it comes to searching for knowledge. Whether you choose a budgeting app or seek the help of a financial advisor, you will find that to be most helpful. Let’s face it, we are not all specialists in every field so finding someone who is, will help us to better stay on track towards financial freedom.

Remember that securing your financial freedom early on will help you reach your goals quicker, and make the process of buying a home or even a car that much easier. Here is to a bright financial future ahead!